nj property tax relief check 2021

For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy. You were a New Jersey.

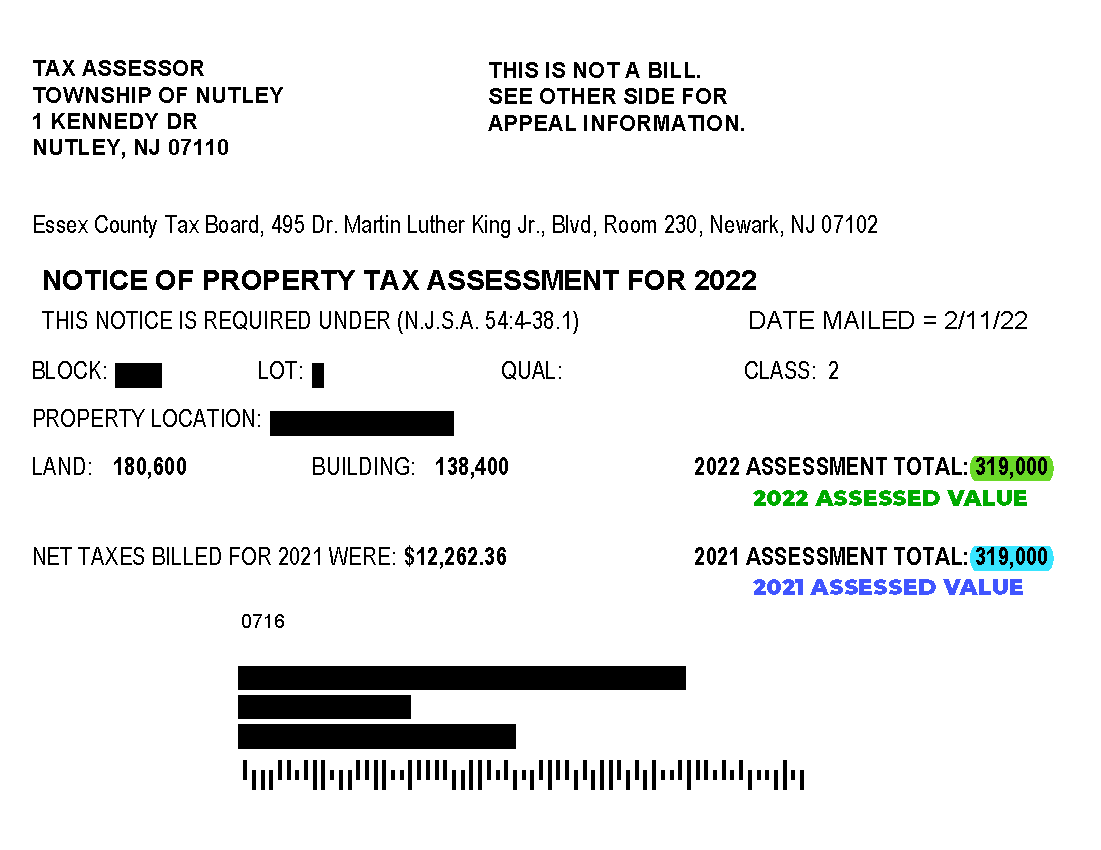

Township Of Nutley New Jersey Property Tax Calculator

You can still file for the 2021 Senior Freeze.

. Based On Circumstances You May Already Qualify For Tax Relief. According to the IRS the refundable tax credit is 50 or. New forms of aid.

Property Tax Relief Programs Homestead Benefit Program Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021. However New Jerseys most. Real Tax Solutions For Real People.

You were a New Jersey. The deadline for 2021 applications is October 31 2022. New Jersey homeowners pay the highest property taxes in the nation and the average bill statewide hit 9284 in 2021 an increase of 172 over the previous year.

See How to File for more information. In 2021 the average New Jersey property tax bill was about 9300. Review the updates to learn whether you may benefit from New Jersey property tax reform measures.

Apply For Tax Forgiveness and get help through the process. They do have a great support team and can be reached. CuraDebt is a company that provides debt relief from Hollywood Florid.

You can view and print the following information regarding your 2017 through 2022 property tax credit checks that have been issued. Governor Phil Murphy is including property. We have begun mailing 2021 Senior.

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. Nj Property Tax Relief Fund Check 2021. Democratic state leaders included a new 2 billion property tax relief program in a 506 billion state budget signed into law Thursday by Gov.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. About the Company Nj Property Tax Relief Checks 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida. The proposal would apply to 18 million residents to help offset the nations highest property taxes averaging 9284 last year.

To be eligible for 2021 property tax relief in New Jersey via the Homestead Benefit Program you must meet all the following requirements. Your prior-year New York State. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Ad See If You Qualify For IRS Fresh Start Program. It was established in 2000 and is a part of the American. For the more than 290000 homeowners with a household income of between 150000 and 250000 a 1000 property tax benefit will be applied each year.

Property Tax Credit Lookup. In 2021 the average New Jersey property tax bill was about 9300. For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey.

Ad Discover A Variety Of Information About Tax Relief Companies. As an alternative taxpayers can file their returns. Free Case Review Begin Online.

For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy said. Word problems examples About the Company Homestead Property Tax Relief Nj 2021 Checks Or Credit To Tax Bill. The state used 2006 tax information to calculate each.

Nj Property Tax Relief Fund Check 2021 They do have a great support team and can be reached them not only through emails but also via phone or making an electronic ticket.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Murphy Signs 50 6 Billion Budget With Property Tax Relief

What Are Personal Property Taxes Turbotax Tax Tips Videos

Ending Delays For Senior Freeze Beneficiaries Nj Spotlight News

Mark To Market Mtm What It Means In Accounting Finance And Investing

Social Housing City Of Hamilton Ontario Canada

Assessed Value Vs Market Value What S The Difference Forbes Advisor

States Without Property Tax In 2022 Ranking Lowest Highest

New York Property Tax Calculator 2020 Empire Center For Public Policy

Selling Rental Real Estate At A Loss Turbotax Tax Tips Videos

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Deducting Property Taxes H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

How Rental Properties Are Taxed 2022 Bungalow

Property Taxes Department Of Tax And Collections County Of Santa Clara